Friday, 18 May 2018

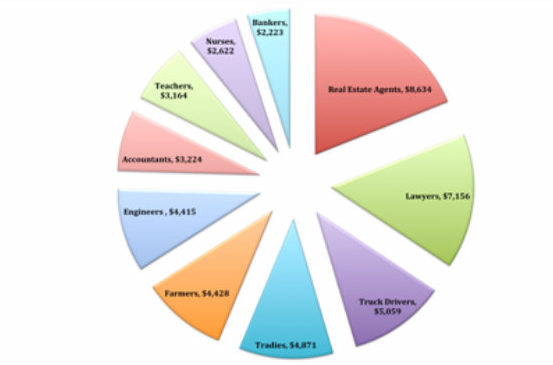

One of the great assets to Australian tax reporting is the opportunity to claim back certain work –related expenses. Recent data shows those in Real Estate take the top of the cake with whopping average of $8,634! This often includes expenses for home office, technology, and renewing costly certificates however the biggest expense is expected to be travel. Real Estate agents use cars exclusively for their work, travelling between offices and listed houses.

The top 10 is packed in on a tight race to the top with figures between $2,000-8,000 in expense claims. Industries of the like include Truck Drivers, Trades People, Lawyers, Farmers and Teachers. Most of these are simply down to the costs of travel and further education. Does this say something about the rising costs of transport and education in Australia?

Interestingly we find Farmers at Number 5 claiming an average of $4,428. Farming is detrimental to the Australian economy and is often considered quite a complex industry branching off many ways. Although each sub-category is entirely different, the common expenses include: equipment & supplies, repairs, and surprisingly your home. You are entitled to deduct expenses if you use your home exclusively for business activities. This typically means if your home in on a farm, and you engage in your business’ administration duties and other related tasks at the house you will be entitles to claim.

The Australian Taxation Office has strict rules for different industries and occupations which affects the statistical averages of each industry. Most of the claims from each industry however are related to travel or car costs.

Second in place after real estate agents are Lawyers, surprisingly coming in a $7,156. The majority of these costs filter from travel relations, to the costs of re-education, charitable donations and gifts. Engineers however, are entitled to claims such as international travel and accommodation, computers and laptops. Accomodation claims also include meals and incidental expenses in a case of emergency.

Teachers, no doubt have a complex role in shaping the lives of our future leaders, unfortunately they face many out-of-pocket expenses during their school year. Some of these include providing students with stationary, books, and further resources not funded by the school. Their professional expenses include applications for working with children checks, education refreshers, union/membership fees, and the list goes on. When you compare the costs of these to the average wage of teachers you may find yourself shocked at the remaining margin. This is explaining just why they sneak in at 8th place.

One of the easiest ways to keep up to date with your tax requirements through the years is to enlist a bookkeeper in Melbourne. No matter which industry your business or employment situation, an experienced bookkeeper will help you on the path to EOFY and tax time. This will take the stress of your shoulders and let you get back to focusing on your success.

When comparing each category take into account the annual salary averages and compare your own claims to each case. Are you getting what you need out of your tax returns? Are you confused and disorganized? Do you have any knowledge of what exactly you need to keep track of all year long? AGI Bookkeeping are a friendly and professional team of Bookkeepers in Melbourne packed full of the knowledge you need to get the ball rolling.

AGI Bookkeeping Melbourne are a team of talented bookkeepers who are the experts in organising your tax documentations and providing quality solutions to help your business succeed. Our talented team can take care of maintaining all your tax needs throughout the year. In doing this, you will have the best possible chance of maximising your tax claims as well as keeping track of all your other taxation needs.

Are you ready to get more out of your tax refund? Get in touch with us to pave the way of on-going financial satisfaction!